pay ohio estimated taxes online

In order to use Easy File you must be. This includes extension and estimated payments original and amended return.

Ohio Taxation Ohiotaxation Twitter

Passwords are case sensitive.

. Allows you to electronically make Ohio individual income and school district income tax payments. Easy File allows individuals to file and pay their Columbus Annual Income Tax Returns IR-25 via credit card debit card or electronic check. Sign In to Pay and See Your Payment History.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self. Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund. You may also use the Online Services portal to pay using a creditdebit card.

We accept online payments for individual income taxes employer withholding and business taxes. You can pay using a debit or credit card online by visiting ACI Payments Inc. 800-282-1780 9 hours ago You.

Also you have the ability to view payments made within the past 61. To make a payment for a business tax visit our online services for business page. The new due dates are April 15 June 15 September 15 and January 15.

2021 Taxohiogov Show details. You are required to pay estimated income tax on Ohio IT 1040ES if the tax due on your 2017 Ohio income tax return reduced by your Ohio tax withheld and refundable tax credits is 500 or. Visit IRSgovpayments to view all the.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. 2021 Taxohiogov Show details. Other ways to pay.

Whether you file your returns electronically or by paper you can pay by electronic check or creditdebit card. If paying by check or money order use the Ohio IT 1040ES andor SD 100ES payment vouchers using the correct year. The Income Tax Divisions Easy File application allows taxpayers to file form IR-25 online as well as make estimated tax payments payments on outstanding liabilities and payments with a.

Estimated tax payments can be made over the phone with our 247 self-service options at 8008607482. Quarterly estimated payments can be made electronically. Estimated Payments Ohio Department Of Taxation.

Login to MyAccount 247 to make estimated tax payments. Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund. The State of Ohio changed the due dates for estimated payments beginning tax year 2018.

If you are experiencing login issues please contact the Ohio Department of Taxations Service Desk at. 800-282-1780 9 hours ago You. Estimated Payments Ohio Department Of Taxation.

View the amount you owe your payment plan details payment history and any scheduled or pending. Income Tax Guest Payment Service allows taxpayers to schedule and remit payments for Individual and School District Income Tax via electronic check or creditdebit card without. Ad Our Free Tax Calculator Is A Great Way To Learn About Your Tax Situation.

The Ohio Department of Taxation will help you find answers to questions about Ohio income taxes including who needs to file a return how and when to file finding the right tax forms and. Ad Our Free Tax Calculator Is A Great Way To Learn About Your Tax Situation. Use Form 1040-ES to figure and pay your estimated tax for 2022.

Ohio ePayment allows you to make your Ohio individual income and school district income payments electronically. City of Kettering Income Tax Division.

Sales And Use Tax Electronic Filing Department Of Taxation

Pay Online Department Of Taxation

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Third Quarter Estimated Tax Payments Due Sept 15 Estimated Tax Payments Tax Payment Irs Taxes

Ohio State Taxes For 2022 Tax Filing Forbes Advisor

Businesses Department Of Taxation

Taxes Faqs Ohio Gov Official Website Of The State Of Ohio

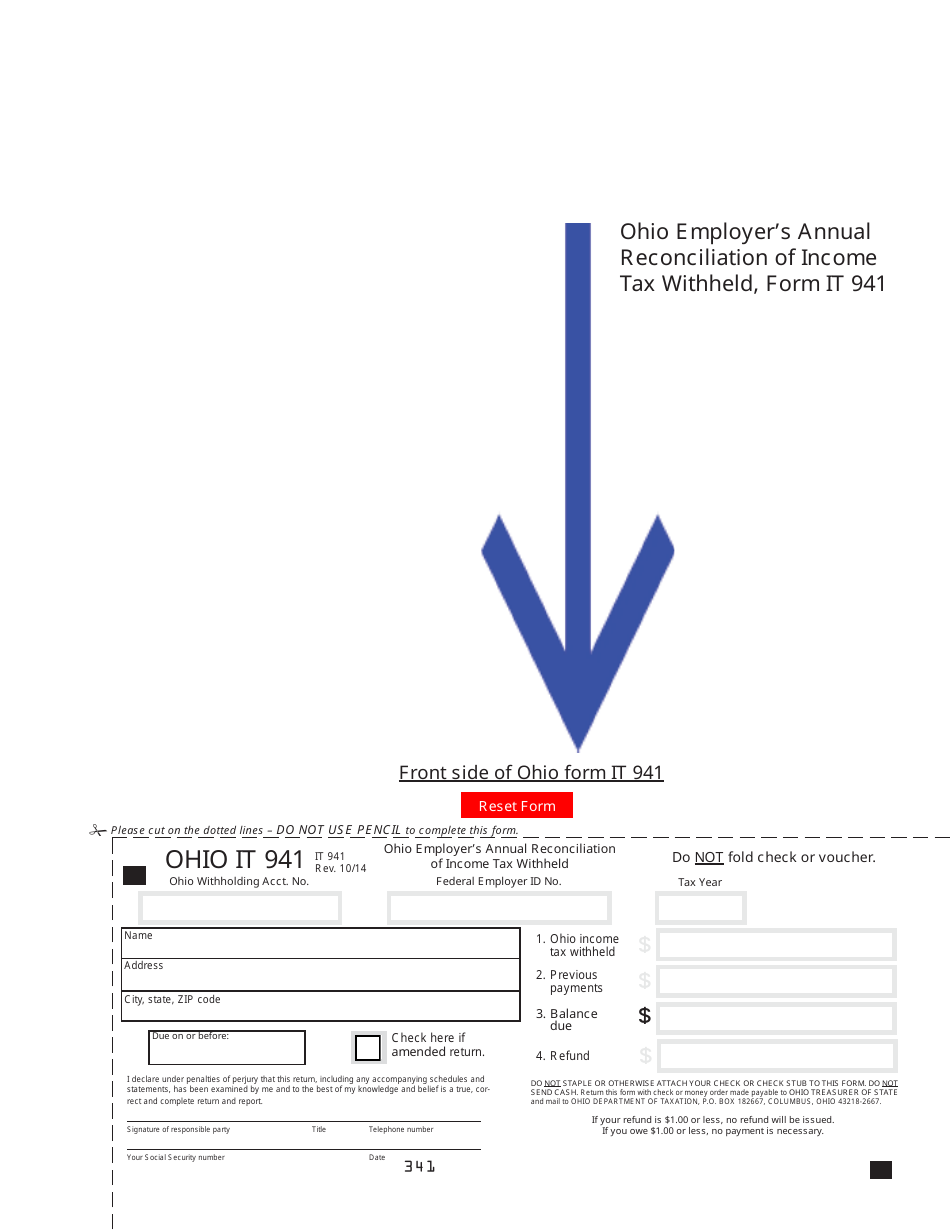

Form It941 Download Fillable Pdf Or Fill Online Ohio Employer S Annual Reconciliation Of Income Tax Withheld Ohio Templateroller

2021 Ohio State Income Taxes Done On Efile Com In 2022

Payments By Electronic Check Or Credit Debit Card Department Of Taxation

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Full Ust 1 Data File Upload Department Of Taxation

Covid Home Workers Could Cause Disruptions To Big City Budgets

Business Tax Pay Online Department Of Taxation

Someone Untied Betsy Devos S Yacht In Ohio Damage Ensued Student Loans Student Loan Debt Home Ownership

Ohio Tax Forms 2021 Printable State Ohio It 1040 Form And It 1040 Instructions